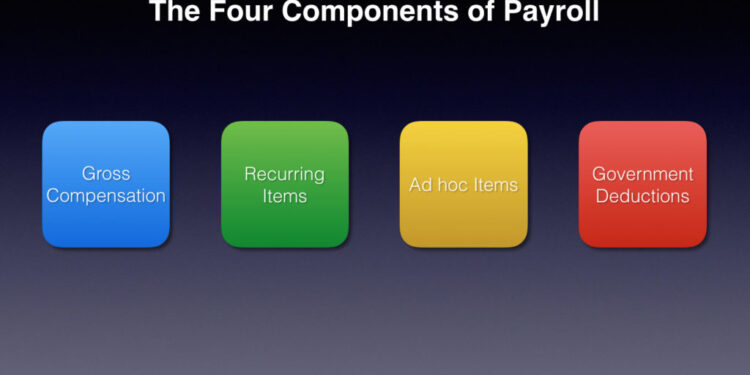

Payroll processing is the most crucial part of an employee-centred business model and it can be a very challenging task to take care of. It is an integral part of business admin, given the vital purpose it plays in keeping track of a company’s financial records. A payroll system ensures that employees get paid and oftentimes at the right time. If you’re serious about creating a successful business that’s built around people, then you need to know what payroll really is as well as some of its more important components. This article will take a look at these components and provide detailed descriptions of each one.

- Gross salary calculation

Gross salary refers to the money you earn ina fixed period. It includes wages and other compensation, such as overtime and bonuses. Gross pay is not adjusted for any deductions like taxes or social security, which can result in a lower net salary than what you actually earned. It also includes all additional forms of compensation and income that are earned by an employee such as wages, tips and commissions.

- Benefits like gratuity, retirement plans and medical insurance

Benefits such as gratuity, retirement plans and medical insurance are often associated with payroll processing. These benefits are paid to the employees during the course of their employment with the company. They should be processed in line with any regulations pertaining to these benefits. It may be difficult to calculate them accurately and systematically which is why things like gratuity calculator formula are extremely helpful. Benefits are typically handled by human resources professionals at companies who administer these programs for their employees.

- Ad hoc pay

These essentially refer to the kind of payments that are not necessarily part of the regular compensation as per the agreement with the employee. These are one-time payments often paid as a form of reward or incentive for performances or festivals or leave encashment. In case the salary is offered in advance after a request from the employee then that is also a part of ad hoc payment.

- Net salary calculation

Net pay is the amount of money that an employer pays an employee after all deductions have been made and before taxes are taken out. Net salary is calculated by subtracting tax deductions from gross salary before it is deposited into an employee’s bank account. If you are worried about the accuracy of the calculation try using a reliable ctc calculator. Common government deductions that form part of net salary include:

- PF: A provident fund is a type of investment fund that is established to offer long-term support for an employee during his or her retirement.

- Housing rent allowance: This is part of the salary wherein the employer offers expenses that the employee incurs towards their rented accommodation.

- Dearness allowance: This is part of the salary that is directed towards the cost of living.

- Leave travel allowance: When an employee travels either with or without the family then the employer offers the leave travel allowance as compensation to cover your travel expenses

- Labour welfare fund: This welfare fund is mainly for offering aid to employees for raising their standard of living.